Supply and Demand, Apollo 11, and GitHub

by Nate Hanrahan

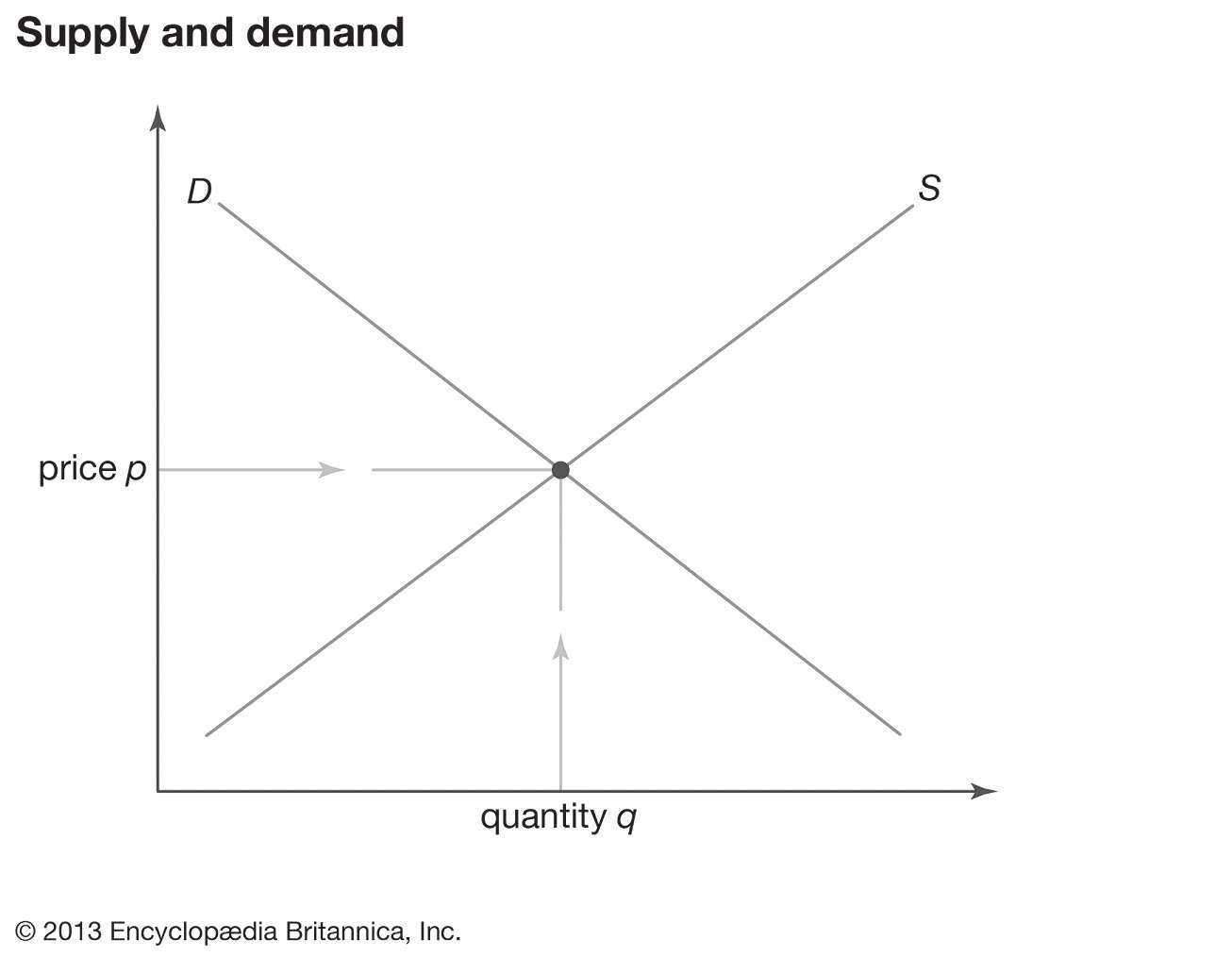

If you have taken an introductory economics course, you most likely saw this graph on the first day of class:

The graph can basically be broken down into three axioms about the supply of products:

- As price increases, suppliers will capitalize on this increase and produce more units.

- As the number of units available increases, the price will decrease because there are more options for consumers to choose from.

- The bracketing of supply and demand goes back-and-forth until an equilibrium of price-per-unit and quantity of unit for sale reaches an ideal equilibrium.

While any microeconomics professor would readily admit that the above model is simplistic, they would still probably assert that it's generally a correct outline of reality. In an economy of cars, clothing, oil, and crops this model makes sense. It's intuitive in a way that makes one think "Yeah, I could've told you that without a graph.' However, there's a particular area of the economy to which this model cannot be applied and that area is growing to affect an outsized portion of the world.

Vitalik Buterin is a software developer and writer.

He is best known for co-creating the cryptocurrency Ethereum, he contributes code to open-source software, and he co-founded a magazine entitled Bitcoin Magazine where he writes. At the end of 2020, he published an article titled "Endnotes on 2020: Crypto and Beyond." He says in his introduction:

"2020 is as good a year as any to ponder a key question: how should we re-evaluate our models of the world? What ways of seeing, understanding, and reasoning about the world are going to be more useful in the decades to come, and what paths are no longer as valuable?"

Buterin, like a lot of people who work in cryptocurrency, is more than a little preoccupied with giving the status quo a shake.

Entrepreneur, investor, and crypto hype-man Balaji Srinivasan can be found most days on Twitter eagerly forecasting the end of credit card companies and centralized journalism as we know them. It's not uncommon for people to readily hope that some established organizations are singing their swan song. What the ilk of Srinivasan and Buterin less commonly criticize are institutions like the Chicago school of economics.

Buterin proposes in his review of the year that our fundamental model of supply and demand doesn't work for much of what the modern economy hinges on: code.

Economics, particularly at the fundamental level that is taught to college freshmen, deals in the physical world. I heard the word "widget" in one year as an economics student more than I think I will for the rest of my life. A widget is a physical thing. Any physical thing: a hammer, pillow, F-15, or bottle of Flex Seal.

Widgets have limits: physical, geographic, and quantifiable limits. According to economics, the limits are the primary driver of price in accordance with the above graph of supply and demand. The issue Buterin takes with economics is that a decreasing share of GDP deals with the widgets of the world. Much of the software which companies, governments, and individuals depend upon has no natural limits.

Compare a commodity like copper to a product like Adobe Acrobat.

There's a finite amount of copper in this world. As humans persistently mine copper from the ground, depleting that amount, the price will reflect the amount believed to be left, and increase over time. Unlike copper, supply has no affect on the price of Adobe Acrobat. A team of software developers has labored to create an environment in which I can fumble around with PDFs, but now that they have created the product, it is finished (barring the occasional update). The amount of Acrobat subscriptions that Adobe can sell is literally only limited by the number of humans on Earth who want to quickly convert PDFs to Microsoft Word docs. A more extreme example of the state of supply and demand in software is demonstrated by NASA.

On July 24, 1969, the United States conclusively won the space race and put men on the moon.

Individuals across competencies came together to accomplish the ultimate defiance of gravity. This giant leap for mankind took years of work by some of the nation's top minds and $152 billion in today's dollars.

Certain parts of the Apollo 11 mission would still be expensive to create and utilize today as they were in 1969: asbestos, aluminum, rocket fuel. Each of these essential components having its price driven in part by the available supply. But one essential component of the Apollo missions was, physically speaking, far more ethereal than asbestos: code.

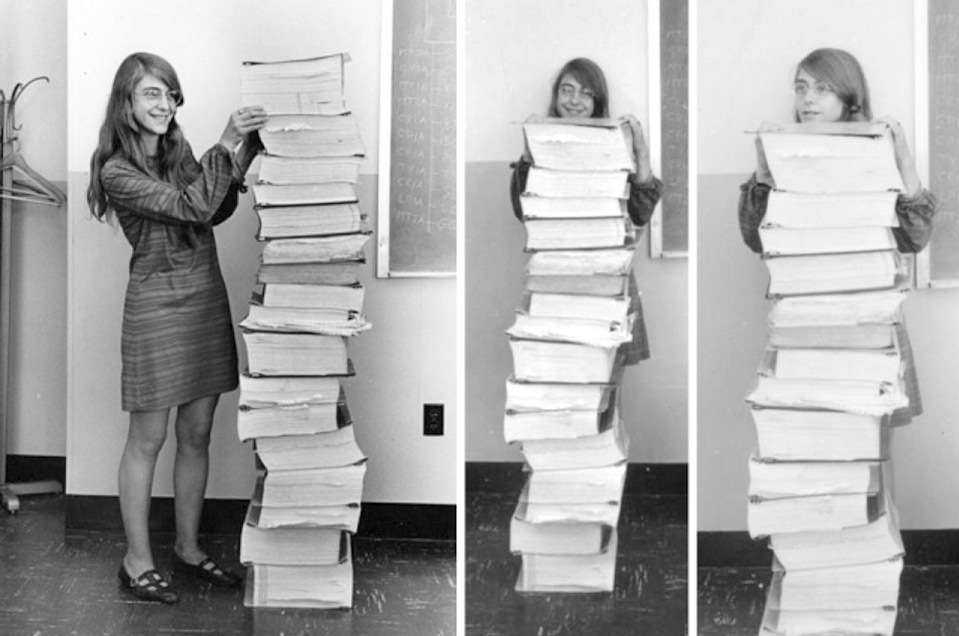

The stories about the massive effort taken to code onboard systems such as the Apollo Guidance Computer (AGC) have been popularized by recent articles and movies. The guidance, navigation, and control of the spacecraft that the AGC oversaw was a necessity for the success of Apollo 11. The code for the AGC was expensive and time-consuming to write (given the nature of U.S./Soviet relations, it was also highly secretive). Unlike a rocket, the price today of the code for the Apollo 11 mission is $0. The supply of the code is now infinite.

Margaret Hamilton with the AGC code that she and others wrote at MIT.

The initial production cost of the Apollo 11 code was massive, but it was a one-time price.

Once it was created, the cost of replication was almost non-existent. You might think that this is an exaggeration. The entirety of the Apollo 11 mission code is available for free on GitHub at: github.com/chrislgarry/Apollo-11

You might also be thinking that this particular example is an outlier. It is. Most software is completely free and much more user friendly than the Apollo 11 code.

The Apollo 11 code wasn't immediately available to the public and wasn't posted to GitHub until 2016. Open-source software is immediately available as it is created, and ubiquitous.

Nadia Eghbal explains in her book Working in Public: The Making and Maintenance of Open-Source Software that one might at first liken the economics of software to that of the music industry.

Music, like software, has a high upfront cost to create, but upon completion you can replicate it with little marginal cost. But Eghbal points out that the music industry could historically rely on vinyl records and discs to artificially limit the supply of music. There would only ever be a finite number of copies of Leonard Cohen CDs. But even the music industry now runs into serious critiques of how it prices artists' work because nearly everyone streams their music instead of purchasing a physical copy.

The number of products containing software in part (Peloton) or in its entirety (Microsoft Office) is high and rising.

How the price of these products is determined in the real world is something that needs to be more accurately modeled. Hopefully we can use a better example than widgets to help do it.